Current Dealer Offerings of Corporate Bonds Can Be Found in:

A municipal bond dealer buys 100M of 30 year non-callable 9 General Obligation bonds at par less 1 point. 18 Thus a large part of syndicate income for corporate debt offerings could be accounted for within days after the date of issuance.

2 2 Review Flashcards Chegg Com

The team has been the 1 ranked underwriter for 9 consecutive years since 2012.

. Most companies could borrow the money from a bank but they view this as a more restrictive and expensive alternative than selling the debt on. Current dealer offerings of corporate bonds can be found in. D yields for revenue bond issues are generally higher than yields for comparable GO.

A issuance of the bonds is dependent on earnings requirements. In return the company agrees to pay interest typically twice per year and. The Vanguard High-Yield Corporate Fund Investor Shares VWEHX for example keeps 45 of its money in US.

Quote providers such as Bloomberg and Reuters give dealer to dealer prices the wholesale market for corporate bonds daily. Corporate bond execution venues and offerings that were a mere idea a few years ago are finally consolidating and starting to bear fruit. 135 rows Read our current corporate bond offerings along with the weekly bond offerings.

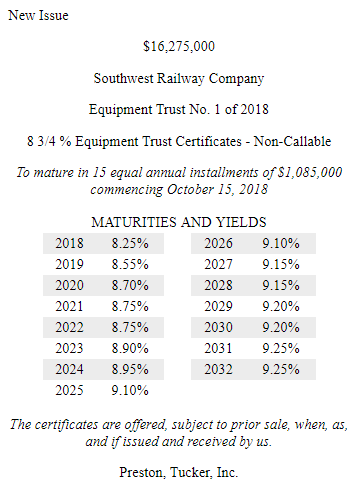

BofA Securities was the 1 overall underwriter of municipal bonds in 2020 serving as senior manager on more than 61 billion of municipal bonds. Gives the details of each corporate new issue that is coming to market. Bonds are generally priced at a face value also called par of 1000 per bond but once the bond hits the open market the asking price can be priced lower than the face value called a discount.

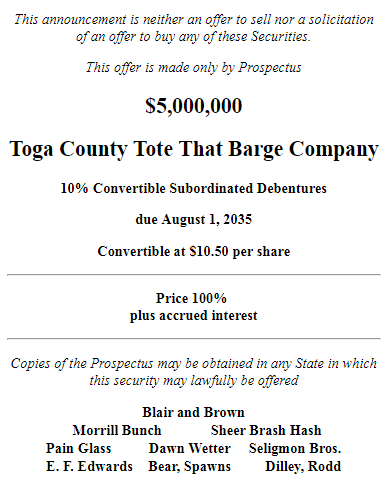

Two-thirds of the investors we spoke with believe that executing corporate bond orders of 1 million in notional size or less is now easy up from 56 the year before. Gives capsule summaries of every outstanding corporate issue including recent price rating and yield d. Among other things the prospectus for a corporate bond offering describes the offering the financial condition of the company issuing the bond how the company plans to use the proceeds from the sale of the bonds the terms of the bond and the significant risks of investing in it.

Companies issue bonds to finance their operations. The most current information on new releases of municipal bonds can be found in A The Bond Buyers Guide B Thomsons Muni Market Monitor formerly Munifacts C The Bond Buyer D the brokerdealers quote sheets. Standard and Poors Bond Guide.

The BWIC process can be found in sales of bonds and currencies among other assets. Wang 2020 found that in more than 95 percent of the debt offerings from 2016 to 2018 the debt security is priced allocated to investors and starts trading in the secondary market all within the same day. In the table below we see two hypothetical agency bonds that are offered for sale by a bond dealerFederal Farm Credit Bank FFCB is a GSE thus carrying an implicit guarantee on its debt while.

Meanwhile the quantity of data. Bonds and 3 in cash while spreading the rest among bonds rated from Baa3 to C. If you are not certain you may want to review SEC interpretations consult with private counsel or ask for advice from the SECs Division of Trading and Markets by calling 202 551-5777 or by sending an e-mail to tradingandmarketssecgov.

Which two of the following most likely apply to this bond today if the current yield-to-maturity is 7 percent. Lists dealer offerings of corporate bonds in the secondary market c. A structure as an interest-only loan II.

C revenue bonds are only suitable for investors willing to assume a high level of risk. Key Takeaways The bid wanted in competition process is used to identify the best market price available for a. The dealers approximate profit or loss per bond on this transaction is.

Designed to provide investors easy access to transparent pricing and trading information in todays debt market the NYSE bond market structure offers corporate bonds including convertibles corporate bonds foreign debt instruments foreign issuer bonds non-US. A yield-to-maturity equal to the coupon rate. Form ATS-N requires disclosures about the manner of operations of the NMS Stock ATS and the ATS-related activities of the broker-dealer operator and its affiliates among other things.

ATSs that do not trade NMS stocks file with the Commission a Form ATS. Reports completed corporate bond trades on a real time basis b. A current yield that equals the coupon rate III.

The Bond Buyer is the municipal new issue newspaper. After holding the bonds in inventory for a week the dealer reoffers the bonds on an 890 basis. Includes weekly bond offerings from various corporations as well as any special corporate offerings in which Edward Jones serves as an underwriter.

Municipal debt offerings include taxable tax-exempt fixed floating short-term financing private. Currency denominated bonds and zero coupon bonds as well as municipal bonds including general. According to broker-dealers with knowledge of the trade Amazon garnered US41bn in orders mid-way through price progression as investors clamored to fund the companys fifth dollar bond offering.

Prospectuses for registered corporate bond offerings are. Information on the broker-dealer registration process is provided below. Fitchs The best answer is B.

A corporate bond is a loan to a company for a predetermined period with a predetermined interest yield it will pay. An 8 percent corporate bond that pays interest semi-annually was issued last year. A current list of NMS Stock ATSs can be found here.

B the bonds may be double barreled with backing by ad valorem taxes.

What Are Corporate Bonds How To Buy Them In The Uk Ig Uk

Comments

Post a Comment